Seiko Chronograph 45mm Quartz Mens Watch With Blue Dial and Stainless Steel Case and Band - Etsy Finland

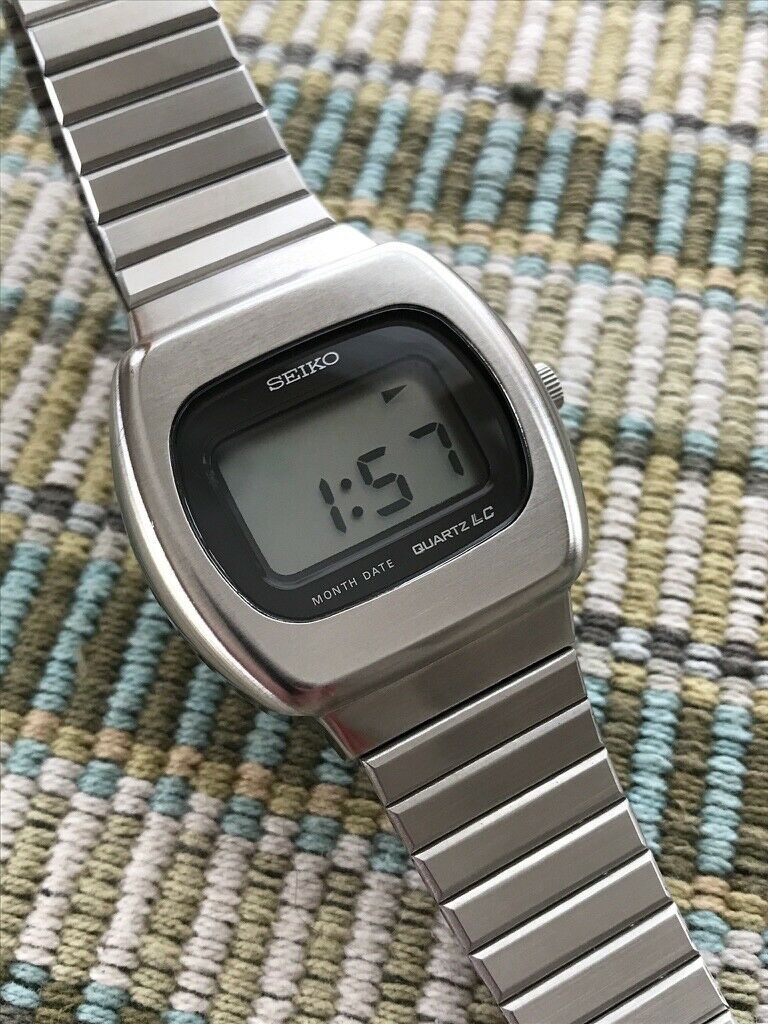

Vintage Seiko Quartz LC Watch Month Date 0532-5009 Collectible-wristwatch Water Resistant,stainless Steel Seikoworking - Etsy

Vintage Seiko Quartz LC Watch Month Date 0532-5009 Collectible-wristwatch Water Resistant,stainless Steel Seikoworking - Etsy

Amazon.com: SEIKO Men's 5 Sports Stainless Steel Automatic Watch with Nylon Strap, Black, 22 (Model: SRPE69) : Clothing, Shoes & Jewelry

SEIKO España - Dos nuevos modelos completamente negros a la colección Seiko 5 Sports Street Style. Estos relojes Seiko 5 Sports vienen en un esquema de color negro monocromático. La pulsera de

Amazon.com: Seiko Women's SYMC18 5 Automatic Gold Dial Gold-Tone Stainless Steel Watch : Seiko: Clothing, Shoes & Jewelry

Amazon.com: Seiko Men's SNK366K 5 Automatic Gold Dial Gold-Tone Stainless Steel Watch : Clothing, Shoes & Jewelry

Amazon.com: Seiko Women's SYMC18 5 Automatic Gold Dial Gold-Tone Stainless Steel Watch : Seiko: Clothing, Shoes & Jewelry

T9 Hybrid Smartwatch Heart Rate Blood Pressure Monitor Waterproof IPS Stylish Smart Watch Seiko Movement For IOS Android

Amazon.com: SEIKO SRPD63 5 Sports Men's Watch Silver-Tone 42.5mm Stainless Steel : Clothing, Shoes & Jewelry

SEIKO España - Presage Style 60's Por primera vez, Seiko Presage ofrece nuevos modelos con correas de nailon que realzan el estilo de los años 60. Los dos relojes presentados con correas

Amazon.com: SEIKO Men's Automatic Analogue Watch with Rubber Strap SKX007K : Clothing, Shoes & Jewelry

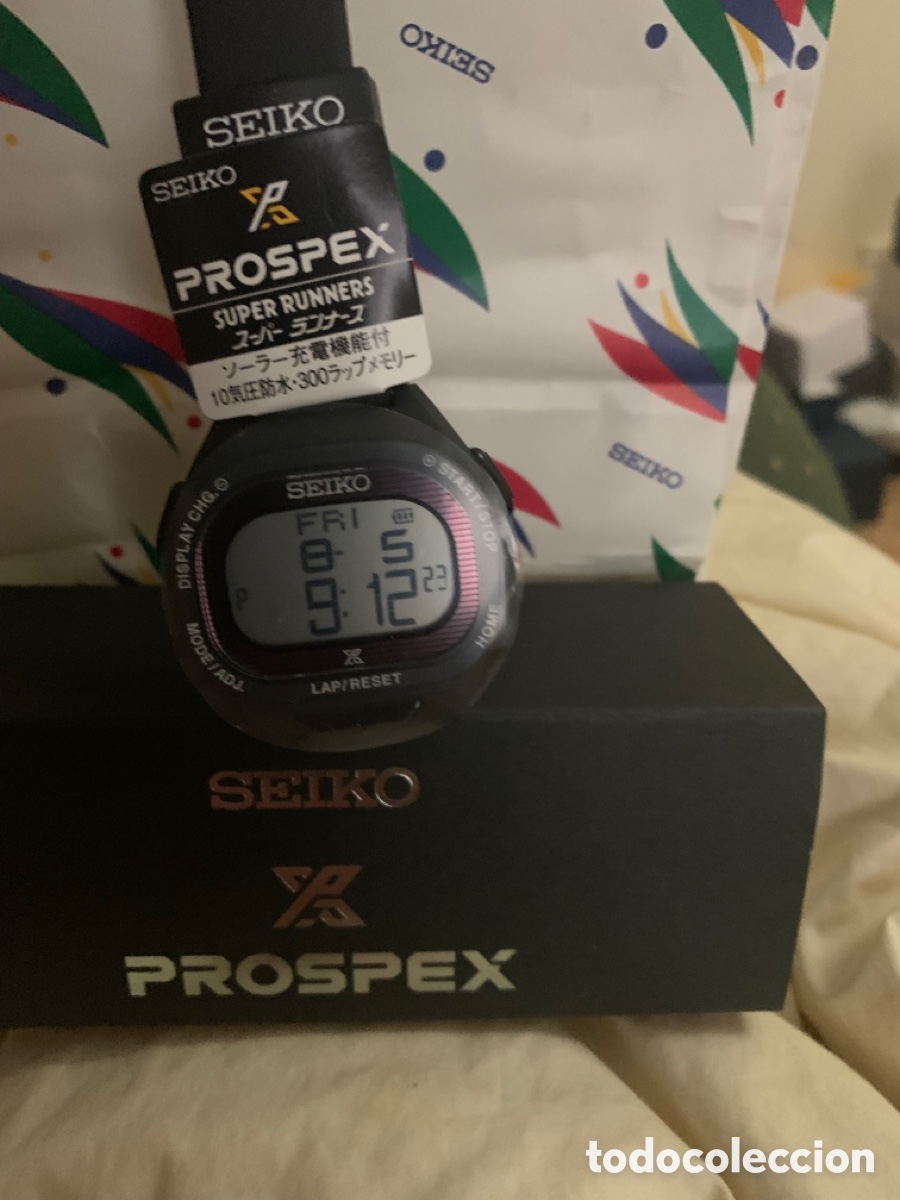

SEIKO España - Seiko Prospex Interpretación Moderna del reloj buceo de 1965 https://www.seikoboutique.es/seiko/colecciones-seiko/prospex-seiko /spb147j1-prospex-diver-s-reedicion-del-reloj-1965 #keepgoingforward #spb147j1 #sbdc105 #seiko #prospex ...

![WTS] 1995 Seiko H557-5370 Alarm Chronograph Watch | WatchCharts Marketplace WTS] 1995 Seiko H557-5370 Alarm Chronograph Watch | WatchCharts Marketplace](https://cdn.watchcharts.com/listings/66f86282-7cd3-487e-94e6-7f28b930017c.jpg)